How can I manage charge types in Scope?

Charge types are managed in the master data module. Go to Master Data > Finance > Charge Types.

Charge Types

Charge types represent individual services that are billed to the customer or billed by a supplier. There are many elements of a charge type that can be

defined, which enables advanced automation of the behavior of the charge type during accounting operations such as issuing invoices or calculating profit

shares. Proper setup of charge types is essential to obtain accurate job-costing from the system. Charge types are assigned a unique code of up to 6 characters. This code is shown as the reference for the charge during jobcosting operations.

Main page

Start: Master Data > Finance > Charge Types

After opening a charge element from the overview

General

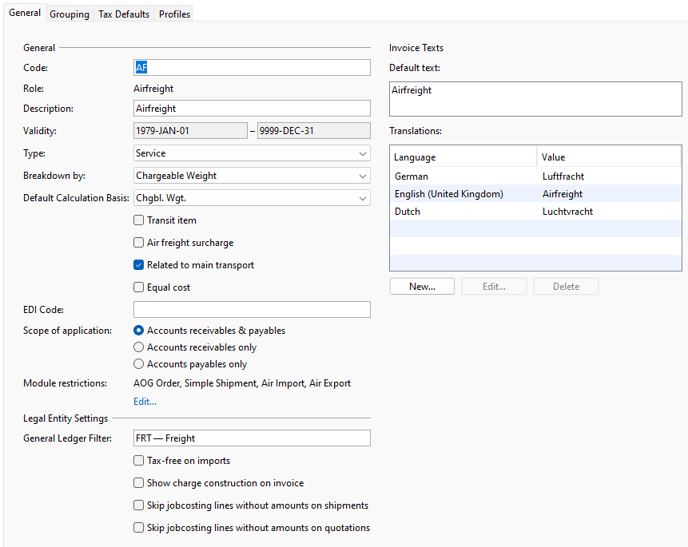

The General tab is where detailed information about the charge type is stored.

Careful maintenance of this area is required to ensure accurate and efficient finance operations.

Explanation of the fields, drop-downs, options and buttons

Code

Any code can be chosen to represent the charge type, but it must be unique and up to 6 digits long. Once saved, this code cannot be changed.

Role

If a new cost element is created, Scope automatically assigns the role "User-defined". For the cost types imported into the system (air freight =AF, sea freight = OF, import duties = DT, ET, VT), Scope assigns air freight, sea freight, VAT and customs duties as roles. These are required, for example, when processing CASS or CusTax messages.

Description

The description of the charge type. Clicking the icon will launch the translation editor. This is used to translate the description into different languages. This enables automatic translation of a charge type description to a different language when a foreign language document is produced.

Validity

Validity period from when to when the cost element can be used. The “to date” can be left blank, meaning that the cost element can be used indefinitely.

Type

Here you must define whether the current cost element is used for services, goods, taxes or customs duties. This information is particularly important for statistical purposes.

Breakdown by

When a charge is applied at a master level, in order to obtain jobcosting figures for the houses on that master, the master charges must be apportioned

among the house shipments. This dropdown menu enables the method of apportioning the charge from master to house to be selected:

|

No breakdown |

The charge is never broken down. |

|

Equally |

The charge will be divided equally amongst all the house shipments. |

|

By chargeable weight |

The charge will be pro-rated according to the chargeable weight of each house shipment. |

|

By gross weight |

The charge will be pro-rated according to the gross weight of each house shipment. |

|

By volume |

The charge will be pro-rated according to the volume of each house shipment. |

|

By number of pieces |

The charge will be pro-rated according to the number of pieces on each house shipment. |

|

By profit share |

The charge will be pro-rated using the Profitshare (CPA) applied to each house shipment. |

Transit item

The checkbox is used to exclude a charge code from profit reporting. This may be desirable for some charges whose income and costs are equal, and therefore there will be no profit or loss on this charge type. This can simplify profit reports by presenting only charges that positively or negatively impact final profit figures.

Air freight surcharge

If this cost type is to be regarded as air freight surcharge, it should be marked so that the correct tax rates are applied when the invoice is created. Example: When importing from third countries, all services that are allocated to the main transportation are to be declared as tax-free. In order to mark these services accordingly, they must be marked as freight charges so that this cost type is declared as standard tax-free when the outgoing document is created.

Related to main transport

Charge on main carriage, not shipment

Equal cost

If a provision with the same amount as on the outgoing invoice is to be created automatically for the stored cost element when closing/printing an outgoing invoice, the cost element should be marked as “Equal costs”.

EDI Code

Code required for an EDI interface.

Scope of application

| Accounts receivables & payables | Indicates that this cost element is to be used for both outgoing and incoming invoices. |

| Accounts receivables only | Indicates that this cost element is only to be used for outgoing documents. The cost element is then not available when creating an incoming document. |

| Accounts payables only | Indicates that this cost element is only to be used for incoming vouchers. The cost element is then not available when creating an outgoing document. |

Legal Entity Settings

G/L filter

Selection of the corresponding G/L account filter to assign the corresponding debit or credit account number depending on taxability and tax country. The G/L account can be found and used in the field search function.

If no value is set here, the charge type cannot be used in the legal entity!

Tax-free on import shipments

If this cost type is selected for an import invoice, no taxes are calculated for this item by default.

Show charge construction on invoice

The calculation of how the amount of the invoice line is made up is also printed on the invoice.

Skip jobcosting lines without amounts on shipments/quotations

These functions are used to determine whether, for example, automated accruals should be created without an amount/rate or whether they should not be displayed.

Module restriction

If the cost element is used for one or more modules, these can be defined here. These cost elements cannot be used in the undefined modules. By default, every cost element can be used in every module. To assign a cost element to one or more modules, click on the blue action link. A dialog box opens in which the modules can be assigned with Add or Remove.

Invoice texts (Default text)

The standard text to be printed on a receipt when using the current cost element can be entered here.

Translations

This option enables various invoice texts to be stored in the corresponding language so that the corresponding description is drawn after the language is selected when the outgoing document is created. If no document text exists, the standard text is used. If no text has been entered there either, the description of the cost element is used when the document is created.

Grouping

On the Grouping tab, the cost elements can be grouped together. This function is used for internal statistical evaluations. Cost elements that are in a group are then evaluated as an overall result in the statistics.

Assign charge type groupOverview of the existing charge element groups to which the charge element can be assigned. The charge type groups must be defined and created beforehand (Master Data > Groups > Charge Type Groups). In this context, it is worth mentioning the “contains not” checkbox, which is displayed during grouping and can be used in the Charge Type Groups application:

| Checkbox 'contains not' |

This function can be used to exclude charge types. An example here is the group 'Charges without Duties': This group excludes customs duties and taxes and, conversely, includes all other available cost elements, existing and future. |

Add

Click Add to assign the cost element to the selected cost element group. The assignment is indicated by a green circle with a tick.

Remove

With Remove, the cost element can be removed from the selected cost element group. A red circle with an X is displayed under Assignment.

Details

The assigned cost elements are displayed under Details.

Tax Defaults

Local tax defaults

The tax codes can be maintained for taxable (VAT) and non-taxable (tax-free) services as follows:

- Tax rate for taxable services: This definition of possible tax codes is drawn during A/R document creation for taxable services.

- Taxrate for taxfree service: This definition of the possible tax codes is used when creating outgoing documents for tax-free services.

Profiles

Similar to the different roles in business partner management, there are also different profiles for cost types, in which data is managed that is only required for a specific business area. The various profiles can be added, edited or removed in this application.

Profile types

| AWB Other charges |

In the AWB Other Charges profile, the IATA Other Charge Code as well as the due date and the text to be printed on the air waybill are defined for the current cost type. For airline specific codes, check this article: |

| Special Services | The Special Handling profile is used to record costs that are entered in the Scope Handling product under Special Services. |

| Mexican Invoicing | SAT code can be added |

| Indian Tax Logic | SAC codes can be defined |

You may also be interested in this:

Why can't I delete cost (charge) types?