Where can I maintain exchange or conversion rates?

Currency exchange or conversion rates are maintained in this application. This data is used in multiple areas of the Scope system such as receivables, payables, quotations and tariffs.

Master Data > Finance > Exchange Rates

These rates are not used for customs declarations. To adjust exchange rates for customs declarations, please check:

https://service.riege.com/en/knowledge/how-can-i-overwrite-the-system-exchange-rates

Exchange Rates/Rate Types

For each currency, it is possible to maintain different types of exchange rates:

|

Rate type |

Description |

Used in |

|

Day Rate |

In general the official exchange rate for converting monetary amounts |

Incoming and Outgoing invoices, Estimates, Quotations (cost) |

|

Buying Rate * |

Exchange rate on a single charge line in foreign currency for an invoice in local currency. |

Outgoing invoices, Quotations (income) |

|

Selling Rate * |

Exchange rate on a single charge line in local currency for a voucher in foreign currency. |

Outgoing invoices, Quotations (income) |

|

Bank Selling Rate |

Special rate on partner debtor profile; |

Outgoing invoices, |

|

Tax invoice rate |

For tax invoices, required in some countries |

Tax invoices |

* For reduction of risk regarding business with foreign currencies, it is normal to add

a mutual buffer at the day rate.

To optimize the above-mentioned cases, the day rate is split into a "buying rate" and "selling rate". At the Settings (of Exchange Rates application) an addition or reduction can be adjusted (Markup). Jump to Import/Download for details.

Examples

For the local currency EUR, a positive mark-up should be selected for the sales rate and a negative mark-up for the purchase rate. For other local currencies, a negative mark-up should be selected for the sales rate and a positive mark-up for the purchase rate due to different exchange rates.

official exchange rate EUR-USD 1.17 and rates with a small addition (1.20) or rather a small reduction (1.10), local currency of forwarder = EUR.

Buying Rate Example:

Invoice in EUR (local currency) with a line about 100 USD (foreign currency)

| Rate on line | Total amount | Result of currency conversion |

| 1.10 | 90.91 | profit |

| 1.17 (official exchange rate) | 85.47 | ~ |

| 1.20 | 83.33 | loss |

Selling Rate Example:

Invoice in USD (foreign currency) with a line about 100 EUR (local currency)

| Rate on line | Total amount | Result of currency conversion |

| 1.10 | 110.00 | loss |

| 1.17 (official exchange rate) | 117.00 | ~ |

| 1.20 | 120.00 | profit |

Import/Download

You need admin rights for these steps.

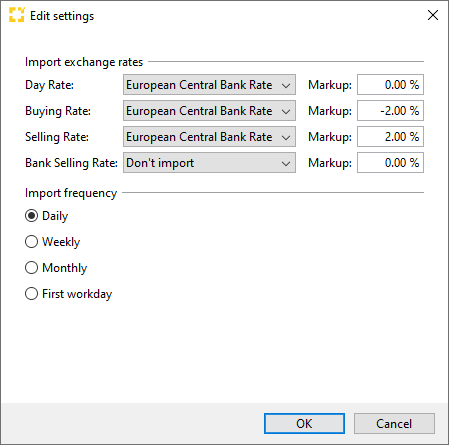

- Click on Settings in the menu band.

- Select the rates download source for all rate types (e.g. European Central Bank Rate).

- Add a markup for addition or reduction, as described before. Note: This example only applies to local currency EUR.

- Select how often rates should be imported (Daily, Weekly, etc.).

- Click OK to save.

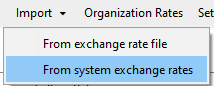

- Go to Import > From system exchange rates.

Scope will use the settings you just made and import the rates right now.

If you skip step 6, the import will be done on the next cycle, as chosen in the Import frequency.

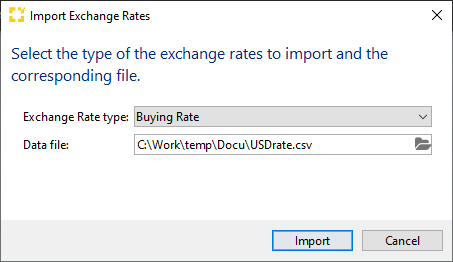

Import of CSV-file

Exchange rates can be imported via CSV file.

Each exchange rate type must be imported separately.

Exchange Rate type

Select the exchange rate type from the drop-down.

Data file

Select the file from the directory.

- Mark the file and select open.

- Click on Import to start the process.

File format

The import file will need to match the following criteria:

- CSV-Format (Semicolon separated file)

- Column names need to match the following list:

|

# Column |

Name |

Description |

|

1 |

baseCurrency |

Three-digit currency code |

|

2 |

rate |

Rate using a comma (,) as a separator |

|

3 |

unit |

Unit |

|

4 |

directQuotation |

Indirect quotation = 0 / Direct quotation = 1 |

|

5 |

validFrom |

Valid from date in format DD.MM.JJJJ |

Example:

|

baseCurrency;rate;unit;directQuotation;validFrom

USD;1,2370;1;0;15.11.2019

|