How can I validate the EU-VAT-ID?

The EU VAT Registration Number can be verified via web, marked as valid manually or marked as valid for domestic use manually.

Master Data > Partner ... Registration IDs (tab)

Verify (F3)

For EU-VAT-ID validation Scope depending on a EU web-service. If this service is unavailable, Scope will show a popup Read time out. http://ec.europa.eu/taxation_customs/vies/

Automatic validation of EU-VAT-ID by activating the option "Validation of EU-VAT-ID with every voucher of payments receivable" - please contact Scope Helpdesk to activate this option.

Manually mark as valid

Manual validation of EU-VAT-ID.

Result: EU-VAT-ID is set to still valid and no automatic validation.

Manually mark as valid for domestic use

Manual validation of EU-VAT-ID only for domestic use.

Result: EU-VAT-ID is set to valid and no automatic validation.

Listing of valid and invalid EU-VAT identification numbers

Settings > Scope Events

Select the filter VAT ID check Events Types.

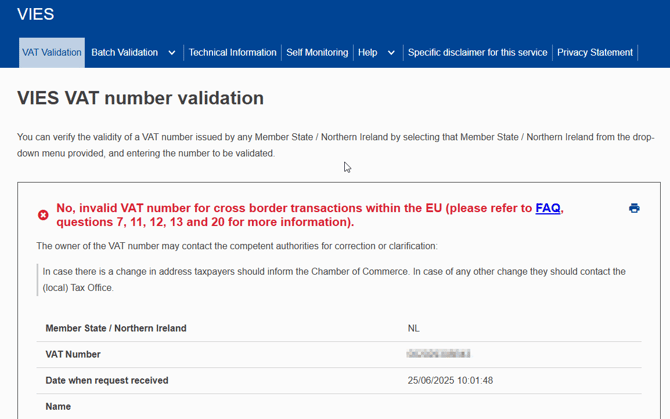

Invalid VAT result

Sometimes, the VIES validation may show a VAT number as invalid, even though the number is confirmed as valid by the provider of the VAT number. This usually happens when the VAT number hasn’t yet been activated for intra-EU (intra-Community) transactions, meaning that it can’t be used for cross-border invoicing within the EU.

Solution

In Scope there is a provision for this allowing a user the set the VAT number as valid for domestic use.

This will result in the following behavior:

-

Invoicing within the same country (partner on Invoice and branch are in the same country):

✅ Invoicing is allowed. -

Invoicing across EU countries (partner on Invoice and branch are in different countries):

❌ Invoicing is blocked due to the VAT number not being valid for intra-EU use.