How can I import tariffs and e-rates?

The rate imports application allows importing buying and selling tariffs as well as e-rates. The tariffs created can be viewed and changed after import in tariffs.

Users needs a specific permission to import rates.

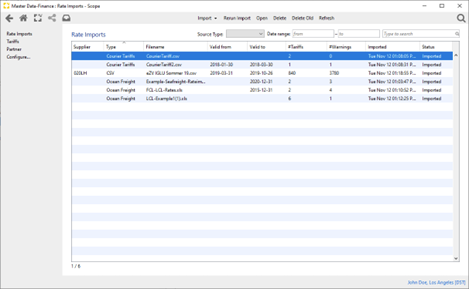

Start: Master Data > Finance > Rate imports

The import function enables importing different kinds of tariffs.

Tariffs for any cost types can be imported.

The import only specifies the layout.

The following options are available:

- Ocean Freight

- Courier Tariffs

- e-rates (CSV)

Ocean Freight

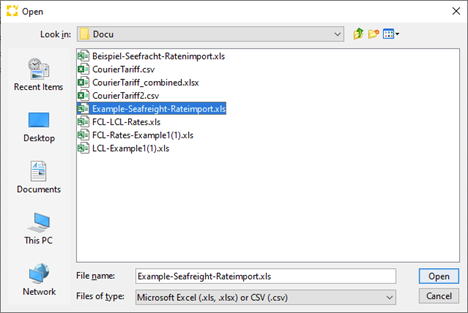

- Select the file for import.

- Format examples:

Example: LCL

|

Column name |

Optional/ |

Description |

|||

|

type |

Mandatory |

Tariff type "buying", "selling" or "internal" |

|||

|

chargeType |

Mandatory |

Charge type code |

|||

|

branch |

Optional |

Branch partner code |

|||

|

module |

Optional |

Module, e.g. "AE", "AI", "SE", "SI" |

|||

| conveyanceType |

Optional |

|

|||

|

LCL basis |

Optional |

Calculation basis for the LCL tariff

|

|||

|

customer |

Optional |

Customer partner or group code |

|||

|

supplier |

Optional |

Supplier partner or group code |

|||

|

shipper |

Optional |

Shipper partner or group code |

|||

|

consignee |

Optional |

Consignee partner or group code |

|||

|

agent |

Optional |

Agent partner or group code |

|||

|

departure |

Optional |

UN/Locode, country code or region code for tariff departure |

|||

|

destination |

Optional |

UN/Locode, country code or region code for tariff destination |

|||

|

product |

Optional |

Product code. For buying tariffs a buying product. Otherwise a selling product. |

|||

|

container depot |

Optional |

Container depot partner or group code |

|||

| zip zone | Optional | ZIP zone code | |||

|

currency |

Mandatory |

3-digit currency code, e.g. USD (ISO 4217) |

|||

|

LCL |

Mandatory |

Rate per M/W |

|||

|

LCL min |

Optional |

Minimum for LCL rate |

|||

|

LCL max |

Optional |

Maximum amount |

|||

|

LCL base |

Optional |

Base amount |

|||

|

LCL units |

Optional |

Units for the default rate breakpoint |

|||

|

validityStart |

Optional |

Validity start of tariff |

|||

|

validityEnd |

Optional |

Validity end of tariff |

|||

|

remarks |

Optional |

Tariff remarks |

|||

|

rate sheet presentation |

Optional |

Tarif rate sheet presentation |

|||

Example: FCL

|

Column name |

Optional/ |

Description |

|

type |

Mandatory |

Tariff type "buying", "selling" or "internal" |

|

departure |

Optional |

UN/Locode, country code or region code for tariff departure |

|

destination |

Optional |

UN/Locode, country code or region code for tariff destination |

| container depot | Optional | Container depot partner or group code |

| zip zone | Optional | ZIP zone code |

|

supplier |

Optional |

Supplier partner or group code |

|

product |

Optional |

Product code. For buying tariffs a buying product. Otherwise a selling product. |

|

customer |

Optional |

Customer partner or group code |

|

currency |

Mandatory |

3-digit currency code, e.g. USD (ISO 4217) |

|

chargeType |

Mandatory |

Charge type code |

|

20DC |

One column is Mandatory |

Example for a container type code. The own container type codes have to be used. |

|

40G0 |

Optional |

Example for a container type code. The own container type codes have to be used. |

| rate | Optional | Rate for the non container-type tariff |

|

shipper |

Optional |

Shipper partner or group code |

|

consignee |

Optional |

Consignee partner or group code |

|

agent |

Optional |

Agent partner or group code |

|

validityStart |

Optional |

Validity start of tariff |

|

validityEnd |

Optional |

Validity end of tariff |

|

conveyanceType |

Optional |

|

|

remarks |

Optional |

Tariff remarks |

|

rate sheet presentation |

Optional |

Tariff rate sheet presentation |

|

branch |

Optional |

Branch partner code |

|

basis |

Optional |

The calculation basis

|

|

base |

Optional |

Base amount |

|

min |

Optional |

Mininum amount |

|

max |

Optional |

Maximum amount |

Example: FCL/LCL

|

Column name |

Optional/Mandatory |

Description | ||||||

| type | Mandatory | Tariff type "buying", "selling" or "internal" | ||||||

| chargeType | Mandatory | Charge type code | ||||||

| branch | Optional | Branch partner code | ||||||

| module | Optional | Module, e.g. "AE", "AI", "SE", "SI" | ||||||

| conveyanceType | Optional | "Sea" the default "Air" "Rail" "Road" "Barge" |

||||||

| LCL basis | Optional | Calculation basis for the LCL tariff "w/m" (default) "volume" "chargeable weight" "gross weight" |

||||||

| customer | Optional | Customer partner or group code | ||||||

| supplier | Optional | Supplier partner or group code | ||||||

| shipper | Optional | Shipper partner or group code | ||||||

| consignee | Optional | Consignee partner or group code | ||||||

| agent | Optional | Agent partner or group code | ||||||

| product | Optional | Product code. For buying tariffs a buying product. Otherwise a selling product. | ||||||

| departure | Optional | UN/LOCODE, country code or region code for tariff departure | ||||||

| destination | Optional | UN/LOCODE, country code or region code for tariff destination | ||||||

| container depot | Optional | UN/LOCODE or region code | ||||||

| zip zone | Optional | ZIP zone code | ||||||

| currency | Mandatory | 3-digit currency code, e.g. USD (ISO 4217) | ||||||

| LCL base | Optional | Base amount | ||||||

| LCL min | Optional | Minimum for LCL rate | ||||||

| LCL max | Optional | Maximum amount | ||||||

| LCL | Mandatory | Rate per M/W | ||||||

| LCL units | Optional | Units for the default rate breakpoint | ||||||

| 20DC | One column is Mandatory | Example for a container type code. The own container type codes have to be used. | ||||||

| 40G0 | Optional |

Example for a container type code. The own container type codes have to be used. |

||||||

| validityStart | Optional | Validity start of tariff | ||||||

| validityEnd | Optional | Validity end of tariff | ||||||

| remarks | Optional | Tariff remarks | ||||||

| rate sheet presentation | Optional | Tariff rate sheet presentation | ||||||

- W/M (weight or measure) = 1m3 = 1.000kg = 1 x w/m. LCL assumes chargeable weight is calculated at 1000 kg per volume factor.

- The columns of the file do not need to be in the order described. As long the the description of the columns matches, Scope can import the tariffs.

Additional containertypes can be added in new columns. FCL and LCL tariffs can be imported in a single file or in different files.

Please find examples for the files here:

Courier Tariffs

Enables importing of selling or buying tariffs for any charge type in XLS or CSV format.

Selling tariff example: Selling tariff csv

Buying tariff example: Buying tariff csv

Courier tariffs can be imported with multiple tables in Excel files - example: Combined xlsx

The format is as follows

|

Column name |

Optional / Mandatory |

Description |

|

type |

Mandatory |

Type of tariff. Possible values: "selling", "buying", "internal" |

|

chargeType |

Mandatory |

Charge type code as maintained in Scope |

|

currency |

Mandatory |

3-digit currency code, e.g. USD (ISO 4217) |

|

product |

Optional |

Product code. For buying tariffs a buying product. Otherwise a selling product. |

|

module |

Optional |

Module, e.g. "AE", "AI", "SE", "SI", "SL" |

|

branch |

Optional |

Branch code |

|

basis |

Optional |

The calculation basis

|

|

user prompt |

Optional/Mandatory |

The user prompt for manual entry tariffs. (mandatory for basis: manual) |

|

volume factor |

Optional |

Volume factor |

|

base Amount |

Optional/Mandatory |

A base amount (mandatory for basis: Base amount only) |

|

min |

Optional |

Minimum amount |

|

max |

Optional |

Maximum amount |

|

departure |

Optional |

UN/LOCODE, country code or region code for tariff Departure |

|

destination |

Optional |

UN/LOCODE, country code or region code for tariff Destination |

|

supplier |

Optional |

Supplier partner or group code |

|

customer |

Optional |

Customer partner or partner group code |

|

shipper |

Optional |

Shipper partner or partner group code |

|

consignee |

Optional |

Consignee partner or partner group code |

|

agent |

Optional |

Agent partner or partner group code |

|

zip Zone |

Optional |

ZIP zone code from Zip zone schema |

|

round |

Optional |

Default is no. When entering yes, the rates of the breakpoint are rounded according to the setting of the currency. |

|

BP FIX x |

Mandatory/Optional |

Describes a breakpoint with the following properties:

|

|

BP STEP x y |

Mandatory/Optional |

Describes a breakpoint with the following properties:

|

|

BP STEP x ACC y |

Mandatory/Optional |

Describes a breakpoint with the following properties:

|

|

BP PROP x y |

Mandatory/Optional |

Describes a breakpoint with the following properties:

|

|

valid From |

Optional |

Valid from date (YYYY-MM-DD) |

|

valid To |

Optional |

Valid to date (YYYY-MM-DD) |

|

DGR level |

Optional |

DGR level of the shipment

|

|

weekdays |

Optional |

Days on which the tariff is applicable like "135" for Monday, Wednesday and Friday |

|

remarks |

Optional |

Tariff remarks |

|

rate sheet presentation |

Optional |

Tariff rate sheet presentation |

When the basis is base amount only, the line must not contain a BP-element. For all other bases, one of the BP-elements is mandatory.

e-rates (CSV)

Scope uses system charge code Airfreight to import rates as buying rates.

This option enables importing of e-rates. Scope allows the import of the old version as well as the new version of the official e-rates sheet, which have been defined by the airlines.

The corresponding file needs to be saved as format ".csv" in order to be imported into Scope correctly.

The first nine lines of the import file are ignored (they usually contain the header data of the e-rates file). When manually creating a file for upload, enter nine empty lines.