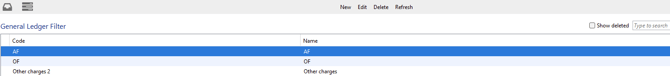

General Ledger Filter in Scope

In accounting, a general ledger account refers to any principal account that directly affects the balance sheet or the profit and loss statement. The assignment of general ledger accounts in Scope is managed through general ledger account filters.

Navigation: Master Data > Finance > General Ledger Filter

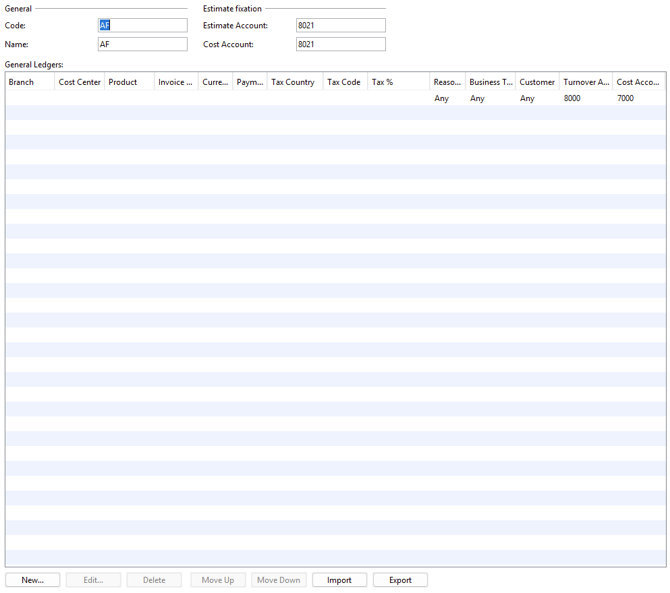

Open entries by double-clicking or by selecting the “Edit...” option below the table.

General

Code

Enter a unique identifier for the general ledger filter in this field. The code can be defined freely, but it must be unique and cannot be duplicated.

Name

Specify a name (designation) for the general ledger filter here.

Month-End Closing (Estimate fixation*)

These settings are necessary only if, during month-end closing (*or Estimate fixation, based on your branch location), you wish to post work in progress and anticipated costs to accounts different from those listed in the table below.

Turnover Account (Estimate Account)

Select the turnover account to be used for month-end closing postings.

(Select the Estimate account to be used for estimate fixations.)

Cost Account

Select the cost account to be used for month-end closing postings.

(Select the cost account to be used for estimate fixations.)

General Ledger Accounts (Table)

The overview table displays all configured general ledger filters, including branch, cost center, product, tax country, tax code, reason code, customer, revenue account, and expense account.

Order

General ledger filters are processed sequentially from top to bottom. As soon as a line in the invoice matches a filter, the associated general ledger account is applied, and filters further down the list are ignored. The most specific filter should be placed first (at the top), and the most general last (at the bottom).

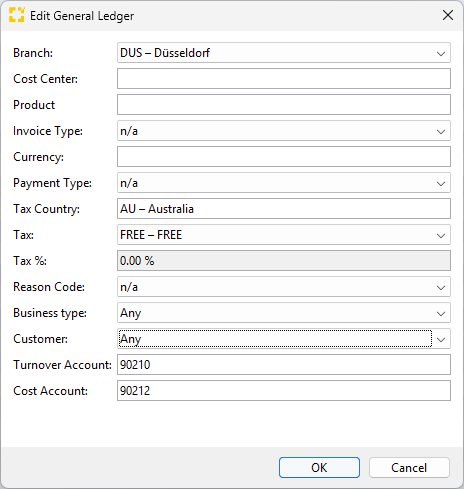

To edit a general ledger entry, double-click or use the “Edit...” button below the table.

Branch

Select the branch for which the general ledger account should be applied. If no branch is set, the account applies to all branches.

Cost Center

Choose the cost center from the drop-down menu.

Product

Select the applicable product from the drop-down list.

Document Type

Currency

Select one of the predefined currencies.

Tax Country

Use the search function to find and set the tax country. If no tax country is selected, the account applies to all countries.

Tax

Select the relevant tax type from the drop-down menu. The available options depend on the tax country and master country data. If no tax type is chosen, the account applies to all tax types.

Reason Code

Select the reason code from the drop-down list, indicating the reason an account is designated as tax-exempt or taxable. The following options are available:

Taxable

Any

RC – Reverse Charge

RC3 – Reverse Charge (3C / third country)

Reverse Charge India

Tax Exempt

n/a

EX – Export

IM – Import

3T – Third Country Transport

TR – Export/Import

DT – Duties

TX – Taxes

3C – Third Country

OS – Offshore

IN – Internal

BG – Bonded Goods

NT – Not taxable

EMB – Embassy

Bollo

Company Type

Select the company type using the drop-down menu, which impacts the taxability of invoices. The following options are available:

- Any

- Business

- Private Person

- Intercompany

Required for intercompany billing and separate account postings. To use intercompany billing, this setting must also be configured in the business partner’s profile. - Embassy

Customer

Choose the customer group using the drop-down menu. The following four options are available:

- Any

- Local/Private Person

- EU

- Third Country

Turnover Account

This is the revenue account to be transferred to the accounting system for outgoing transactions.

Cost Account

This is the expense account to be transferred to the accounting system for incoming transactions.