How are tariffs calculated and what role does the tariff basis play?

To successfully accomplish the desired calculations with tariffs, the basis of the tariff is a decisive factor. This article provides you with selected, practice-oriented examples using different bases.

The following bases are explained in more detail in this article using a practical example:

- Base amount only

- Chargeable Weight

- Positions in customs declaration

- Container Type

- Amount Charge Type (Costs)

- Amount Charge Type List (Costs)

- Manual Entry

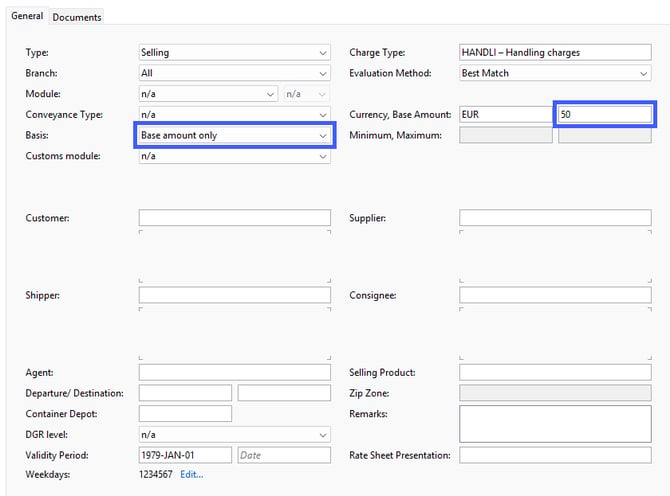

Basis: Base amount only

Example: You want to charge your customer a standard fee of 50.00 EUR for the cost type Handling.

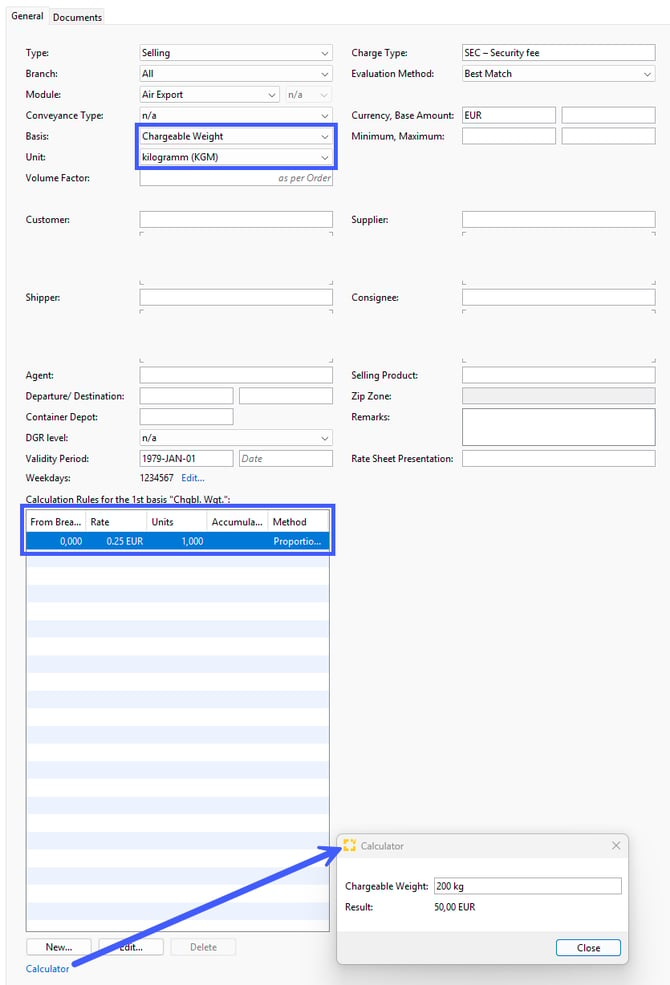

Basis: Chargeable Weight

Example: You want to charge your customer the security fee by chargeable weight at a rate of 0.25 EUR per kg.

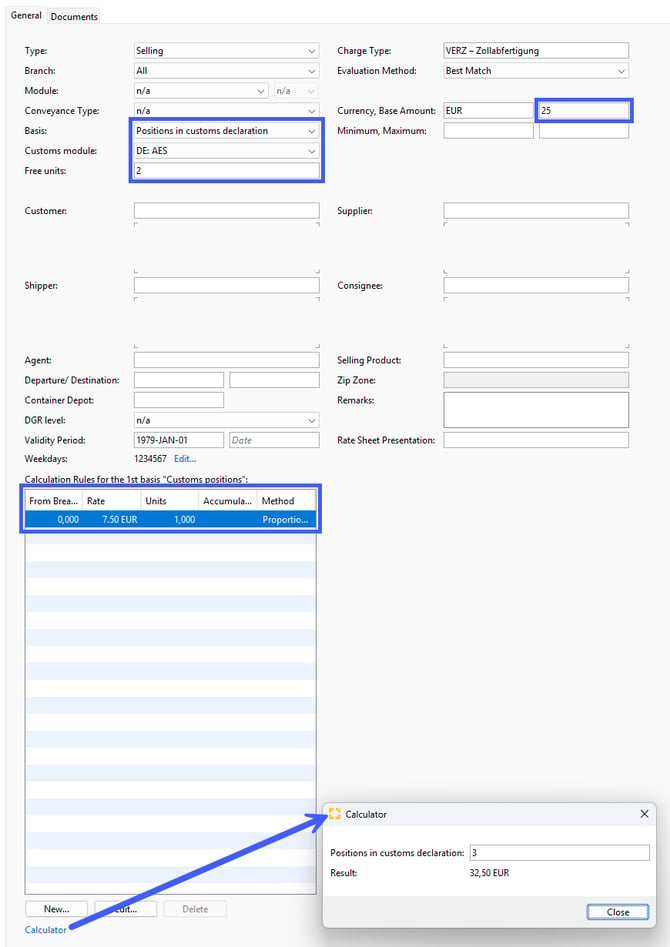

Basis: Positions in customs declaration

Beispiel: You want to charge your customer for the customs declaration in the module AES a base amount of 25.00 EUR, including 2 free positions and for each additional position another 7.50 EUR.

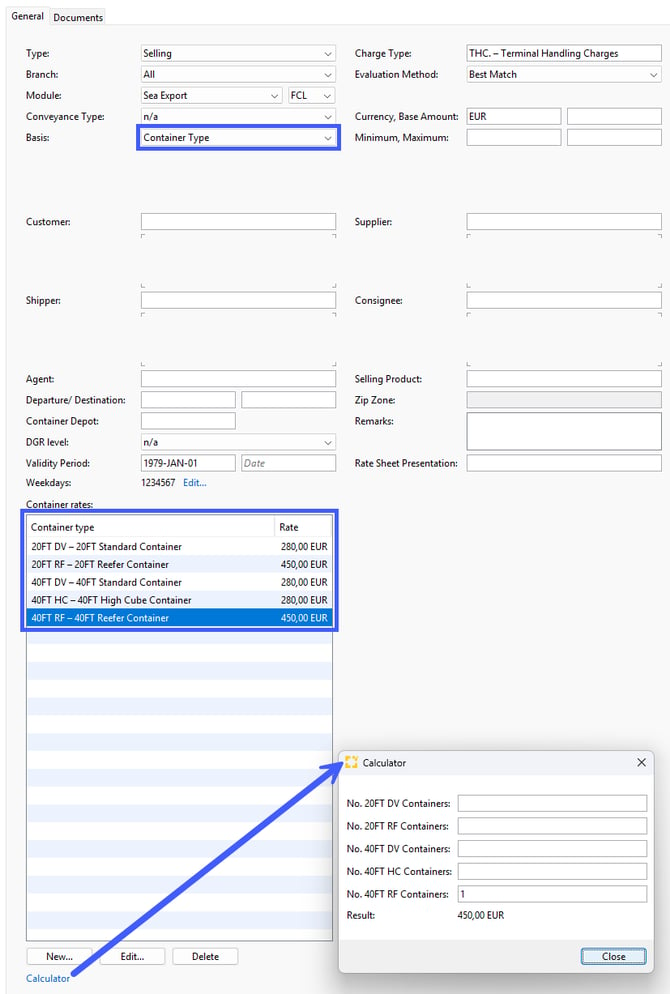

Basis: Container Type

Example: You want to charge your customer THC (Terminal Handling Charge) for all dry container at a rate of 280.00 EUR and for reefer container 450.00 EUR.

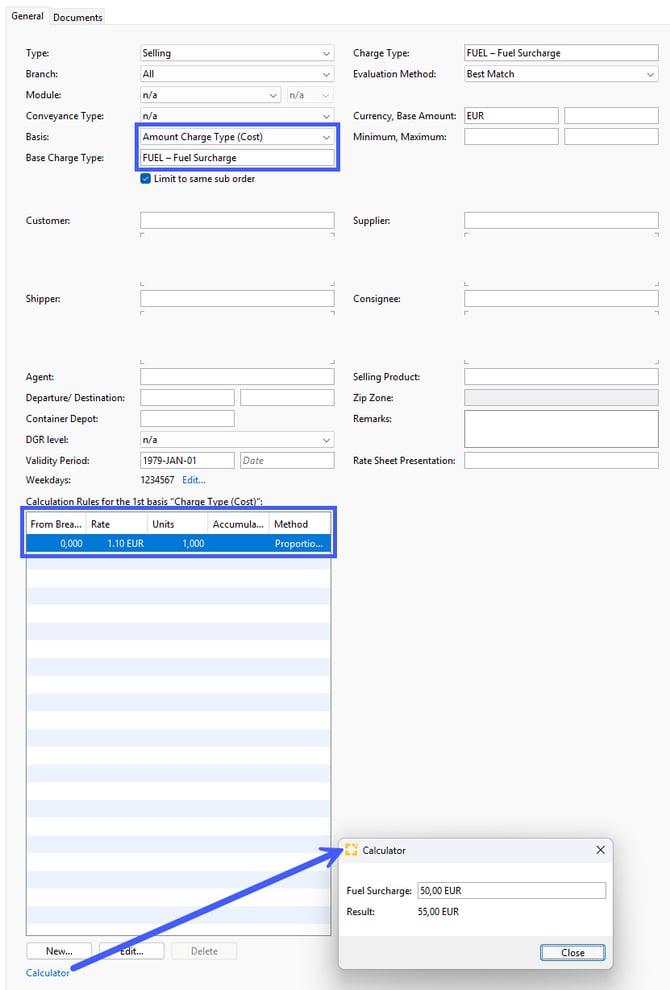

Basis: Amount Charge Type (Cost)

Example: Your selling rate for the fuel surcharge shall be 10% on top of the buying rate of the fuel surcharge.

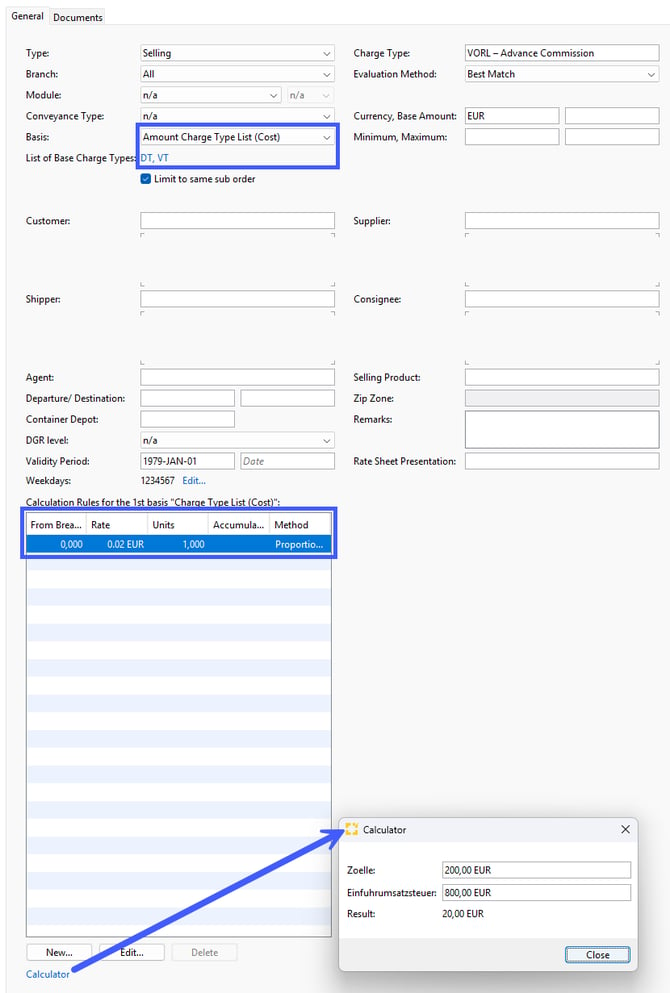

Basis: Amount Charge Type List (Cost)

Example: You want to charge your customer the advance commission at a rate of 2% based on the sum of the costs of DT = Import Duties and VT = Import VAT.

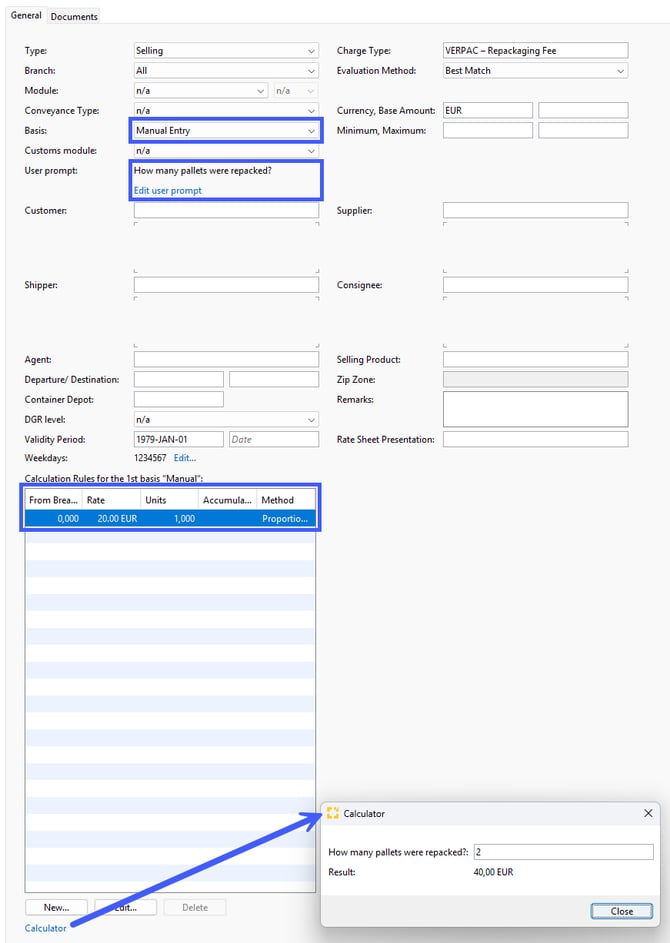

Basis: Manuelle Eingabe

Beispiel: You had to repack some pallets for your customer and want to charge him 20.00 EUR per pallet.

You can find an overview of all available bases here