How do I create a tariff?

In the Tariffs application you can add and maintain selling tariffs, buying Tariff and IATA rates.

Addition of a new tariff

Master data > Finance > Tariffs

Upon opening the tariff application, a complete list of all currently defined tariffs is displayed. To create a new tariff, select New from the menu bar and choose the desired tariff type:

- Selling Tariff

- Buying Tariff

- IATA Rate

- Internal Tariff

- Agent Tariff

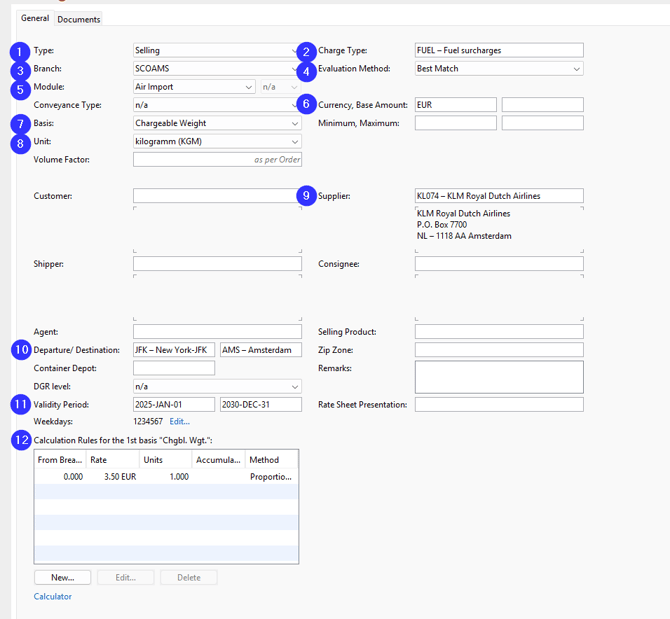

The following example illustrates an air import fuel surcharge tariff.

(1) Type: This is automatically set to Selling for the sales tariffs (income), and is to be adjusted to Buying for the purchase tariffs (costs).

(2) Charge Type: The tariff will only apply to this charge type.

(3) Branch: This can be set to a specific branch so that the tariff does not apply to the other branches. If left empty, it applies to all branches of the legal entity.

(4) Evaluation Method: The default Best Match is the usual method for calculating a tariff. Next minimum will ensure that the lowest possible outcome from the breakpoint values is used. Previous maximum will ensure that the highest possible outcome from the breakpoint values is used.

(5) Module: If module is set to Air Import, this tariff will only apply to air import shipments.

Conveyance type is meant for the conveyance type of a Simple Shipment or the conveyance type of the pickup/delivery transport orders of the shipments. In most cases it can be left empty.

(6) Currency: Choose a currency (e.g. EUR or USD). This the currency in which the tariff is calculated.

(7) Basis: e.g. Chargeable Weight, see Which Basis can I use for my tariff?

(8) Unit: Use KGM if this is to be used for the calculation.

(9) Supplier: The Supplier can be left empty. If the airline KLM Royal Dutch Airlines is selected as the Supplier, this tariff will only apply to shipments done via this airline.

(10) Departure/Destination: Both Departure and Destination fields can be left empty, contain a country code, region code, or a specific location code. For example, in order to restrict the applicability of this tariff, the departure airport "JFK" and destination airport "AMS" can be entered to restrict thee tariff to flights between Amsterdam and Philadelphia.

(11) Validity Period: These fields are used to specify the period for which the tariff is active.

(12) Calculation Rules: The tariff calculates $3.50 per Kg (Chargeable weight). Use the New button to enter new breakpoints and the Edit button to adjust an existing breakpoint. The Proportional method calculates charges based on the specified basis and unit of measurement. The Step method rounds up to the nearest whole unit of the basis. In contrast, the Fixed method sets a specific price that remains unchanged between breakpoints, eliminating any additional calculations.

Depending on your screen setup, you might need to scroll down the page to view all available options. At the bottom of the screen, there is a blue Calculator link that allows you to test and validate your tariff calculations.

Related articles about tariffs and the basis for tariffs:

Which Basis can I use for my tariff?

How are tariffs calculated and what role does the tariff basis play?